The U.S. financial system saved rising at a modest clip as 2019 drew to an in depth, whereas a deterioration in manufacturing employment belied general tight job market circumstances throughout the nation, a Federal Reserve survey confirmed.

“Plenty of Districts reported job cuts or decreased hiring amongst producers, and there have been scattered stories of job cuts within the transportation and vitality sectors,” based on the report launched Wednesday.

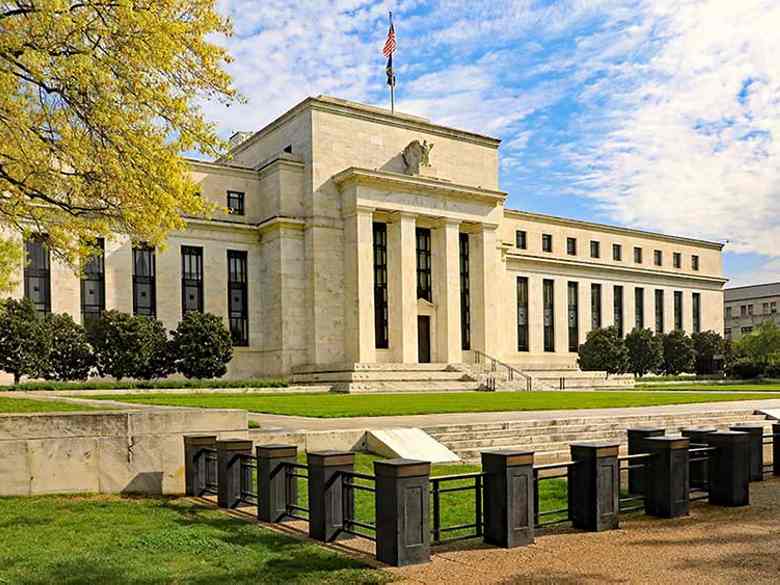

The central financial institution’s Beige E book financial report, based mostly on anecdotal data collected by the 12 regional Fed banks by Jan. 6, additionally confirmed inflation on the shopper and producer ranges “continued to rise at a modest tempo.”

The Beige E book, ready by the New York Fed, helps central bankers’ December resolution to depart rates of interest unchanged following three cuts in 2019. Most officers favored protecting charges on maintain for all 2020, their projections confirmed, except there was a fabric change within the financial outlook.

Regardless of weaker exercise and employment on the nation’s factories, the labor market general “remained tight,” with most districts citing “widespread labor shortages as an element constraining job development.” Unemployment stood at a half-century low of three.5% in December.

The Federal Reserve Financial institution of Atlanta reported wage pressures remained “for lower-skilled positions, and a few contacts count on increased wages within the coming 12 months.” Within the San Francisco Fed’s district, a number of contacts stated that employee shortages have been a “vital” impediment to firms’ means to broaden.

The St. Louis Fed stated that companies have been reducing hiring requirements, elevating advantages, automating positions and giving workers extra tasks “resulting from continual employee shortages.”

Within the San Francisco Fed district, many companies together with skilled service suppliers and monetary firms, reported elevating costs resulting from increased labor prices. On the similar time, companies in know-how and retail stated competitors was restricted their means to go by wage will increase.

“These Districts reporting on worth expectations indicated that costs have been anticipated to proceed to rise within the months forward,” the Beige E book stated.

The Fed’s most popular gauge of worth pressures excluding meals and vitality rose 1.6% within the 12 months by November. Inflation has run persistently under the central financial institution’s 2% goal for a lot of the previous seven years.