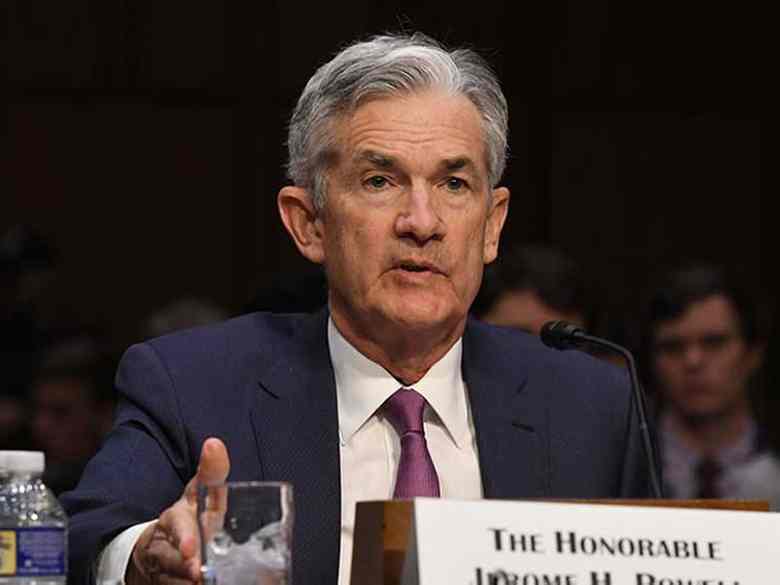

Federal Reserve chief Jerome Powell on Monday responded to the legion of economists casting doubt on policymakers’ Goldilocks forecast issued final week. However his rebuttal seems solely to have left traders bracing for extra aggressive tightening. After the discharge of Powell’s speech, the Dow Jones Industrial Common slipped additional, whereas the Nasdaq reversed decrease.

Powell basically delivered two messages that some may see as contradictory. First, opposite to traditional knowledge, Fed charge hikes have not led to recession each time, apart from the 1994 tightening, he stated. Second, the Fed is ready to tighten rather more aggressively than it indicated final week.

Shortly after the speech transcript was launched, at round 12:30 p.m. ET, Treasury yields spiked. The ten-year yield surged 14 foundation factors to 2.29%, its highest level since Could 2019. Now markets are pricing-in about 62% odds of a half-point charge hike on Could 4, up from 44% on Friday, based on CME Group’s FedWatch web page.

“If we conclude that it’s acceptable to maneuver extra aggressively by elevating the federal funds charge by greater than 25 foundation factors at a gathering or conferences, we are going to achieve this,” Powell stated.

Powell’s newest speech appeared to underscore what some economists had already concluded. The seven charge hikes penciled in for 2022 eventually week’s assembly have been “merely a ground,” not a base case, Jefferies chief U.S. monetary economist Aneta Markowska wrote Friday.

Dow Jones Slips After Powell Rally

The Dow Jones pared its loss to 0.65% simply earlier than the shut, snapping a four-day advance. The S&P 500 narrowed losses to 0.1%, whereas the Nasdaq shed 0.5%.

A inventory market pullback is not shocking after final week’s rally. The Dow recorded its greatest weekly achieve since Nov. 6, 2020, rising 5.5%. The Nasdaq scored a ten.4% transfer over 4 days.

Powell’s Wednesday information convention supplied the spark. He expressed optimism that the Fed may rein in inflation with out derailing progress. He and others search a coverage that is not too scorching or too chilly, deemed the Goldilocks strategy.

Powell’s feedback Monday threw chilly water on a rally that he in all probability didn’t intend to ignite within the first place. It is unlikely that the Fed chief would deliberately purpose to ship inventory costs decrease. However a weaker market does play into the Fed’s purpose to “reasonable demand progress.”

“The robust monetary place of households,” Powell stated, is a contributor to decrease labor pressure participation that is fueling wage progress. Powell stated the Fed may finalize its plan to start paring its stability sheet on the subsequent assembly.

Consultants usually see fed asset purchases as a optimistic for inventory costs. Fed shopping for of low-risk authorities securities holds down rates of interest, thus encouraging risk-taking and underpinning inventory valuations. The reverse course of, dubbed quantitative tightening, is subsequently a headwind for the inventory market. How robust a headwind, in fact, is tough to say.

Is Federal Reserve Recession A Threat?

The Fed has solely simply begun climbing its key charge from close to zero. A fair sooner tempo of charge hikes ought to nonetheless depart financial coverage fairly unfastened for a while. The danger to the financial system would come if charge hikes aren’t slowing the financial system sufficient to decrease the specter of too-high inflation.

The Fed’s quarterly projections noticed progress moderating to 2.8% this yr and a pair of.2% subsequent — nonetheless reasonably above what the Fed considers the financial system’s long-term development. Unemployment is seen falling to three.5% this yr and holding there. But the Fed’s major inflation-rate indicator is seen easing to 4.3% this yr and a pair of.7% subsequent.

To quite a few economists, it appears unlikely that the Fed can rein in inflation with out pushing up unemployment. Some cite the info level that Powell took challenge with, an almost good report of Fed tightening producing a recession.

Exceptions To Smooth Landings

Powell famous 1965, 1984 and 1994 as exceptions that delivered mushy or “soft-ish” landings. He additionally cited the 2015 to 2019 Federal Reserve tightening, which preceded recession, however the recession due to Covid, not the Fed.

But none of these examples provides a lot purpose for optimism. The primary, 1965, was at the start of the inflationary guns-and-butter period, hardly an instance for right this moment’s policymakers to comply with.

Each 1965 and 1994 got here after deep recessions, when unemployment was nonetheless elevated. The 2015-19 interval noticed inflation operating beneath goal, so it was straightforward for the Fed to reverse course when the financial system weakened.

The present state of affairs, with the labor market tight to an “unhealthy” extent and inflation at a 40-year excessive, provides a very totally different problem. Powell and the Fed have to catch a break for this to work out. There’s a likelihood that they might.

However thus far, the Covid spikes and Russia’s invasion of Ukraine preserve making the job more durable.