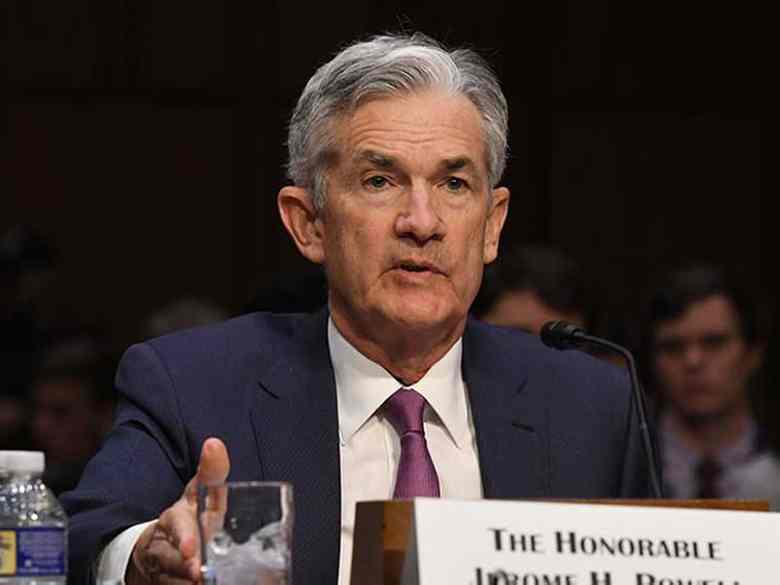

Federal Reserve chief Jerome Powell’s vow on Wednesday to rein in inflation was, within the view of Jefferies economics crew, his “no matter it takes” second, akin to central banker Mario Draghi’s pledge to avoid wasting the euro. The Fed’s plan for seven rate-hikes this 12 months — a couple of greater than Wall Avenue anticipated — initially led the inventory market rally to falter. Then Powell’s bullish outlook for the U.S. economic system propelled the S&P 500 to session highs on Wednesday.

In Thursday’s inventory market motion, the S&P 500 and different main indexes tacked on additional stable positive factors. The S&P 500 and Dow Jones rose 1.2%, whereas the Nasdaq popped 1.3%. Tentative progress in Russia-Ukraine negotiations additionally might have helped whet traders’ danger urge for food. Shares had been extra blended, however largely greater early Friday.

But these Federal Reserve’s coverage alerts deserve a better look. Ought to they actually make traders bullish concerning the coming months?

This was the important thing line in Powell’s post-meeting press convention: “The plan is to revive value stability whereas additionally sustaining a robust labor market. That’s our intention, and we imagine we are able to try this. However now we have to revive value stability.”

Left unsaid: The Fed will not draw back from pushing up unemployment, if vital, to stop excessive inflation from changing into a continual drawback for the U.S. economic system.

Getting management of inflation must be good for the S&P 500 and inventory market within the longer run. However the quick run may nonetheless be rocky.

In discussing the trail of the U.S. economic system this 12 months, Powell indicated that dangers tilt to inflation operating even greater than anticipated.

Russia’s invasion of Ukraine will possible add “upward stress on inflation and weigh on financial exercise,” the Fed coverage assertion mentioned. The Feb. 24 assault fueled value spikes for a broad vary of commodities, together with oil, aluminum, nickel, wheat and fertilizer, amid precise and potential provide disruptions.

China’s largest Covid flare-up because the unique Wuhan outbreak additionally poses upside inflation danger amid lockdowns in key manufacturing hubs. It additionally may weigh on international progress.

Powell acknowledged that, in hindsight, the Fed “clearly” ought to have moved to tighten coverage earlier, and now should play catch-up.

The Fed is ready on “getting charges again as much as extra impartial ranges as shortly as we practicably can after which shifting past that, if that seems to be acceptable,” Powell mentioned.

In different phrases, Federal Reserve policymakers will hike greater than 1.75 proportion factors — seven quarter-point strikes — this 12 months, in the event that they really feel they’ll accomplish that with out tanking the economic system. There are solely six conferences left. Nonetheless, markets are pricing in 33% odds of a half-point hike on the Could 3-4 assembly, in accordance with CME Group’s FedWatch web page.

Powell’s wording additionally implies that the Fed might hike greater than seven occasions this 12 months — no matter danger to the U.S. economic system — if policymakers suppose it’s a necessity to comprise inflation danger.

Truly, it could be extra correct to say that the Fed already plans eight charge hikes this 12 months. “Shrinkage of the stability sheet,” Powell mentioned, “is likely to be the equal of one other charge improve.”

Market Rally Builds Momentum; Tesla Prepared To Cost?

No Powell Put For S&P 500

On Wednesday, the Fed mentioned it might start to pare again asset holdings “at a coming assembly.” The U.S. central financial institution purchased $4.5 trillion in Treasuries and government-backed mortgage securities beginning in March 2020.

As these bonds attain maturity, the Fed will now not reinvest all of the principal. As an alternative, a few of these belongings will run off the stability sheet.

Federal Reserve asset purchases, most observers agree, have a constructive impression on inventory costs. Fed shopping for of low-risk authorities securities holds down rates of interest, encouraging risk-taking and underpinning inventory valuations. The reverse course of, dubbed quantitative tightening (QT), is due to this fact a headwind for shares.

Again in September 2018, because the Fed hiked charges and shrunk its stability sheet, Powell addressed what may immediate a coverage change. Powell set the bar at a “vital correction and lasting correction in monetary markets.”

Solely after the S&P 500 selloff reached 20%, flirting with bear market territory, did Powell and his colleagues do an about-face. The Fed slowed balance-sheet runoff in early 2019. By August, the Fed began slicing charges.

Given Powell’s dedication to rein in inflation, it is uncertain {that a} bear market would immediate a near-term coverage shift. The Nasdaq composite is now 16% off its report excessive. This week’s rally lifted the tech-heavy index out of bear-market territory. In the meantime, the S&P 500 stands 9% under its peak and the Dow Jones industrial common has misplaced 7%.

The purpose is not that recession for the U.S. economic system and a bear marketplace for the S&P 500 are sure. But dangers abound, and the Fed is unlikely to come back to the rescue until and till what Powell calls “the true economic system” — not simply monetary markets — are exhibiting indicators of misery.

Powell’s ‘Painless Path’

Deutsche Financial institution chief U.S. economist Matthew Luzzetti titled his observe on the Fed assembly, “A painless path to cost stability?”

Each Powell’s feedback and policymakers’ quarterly financial projections counsel Fed committee members are sanguine about prospects for with the ability to rein in inflation and keep a robust labor market.

Luzzetti does not share their optimism. He sees larger odds that value stability will solely come “with a extra vital discount in progress and a rise in unemployment, in keeping with heightened recession dangers past this 12 months.”

For the second, the Fed’s benign view of the rate-hike trajectory and inflation outlook appear to have carried the day amongst traders. But after policymakers’ collection of historic misjudgments, their newest forecast could be the final hope for preserving the S&P 500 bull market. If inflation and the labor market proceed to run hotter than anticipated, traders might start to cost within the Plan B that Powell solely hinted at.