The Federal Reserve maintained its ultra-easy coverage, as anticipated, on Wednesday, however signaled it is getting a better to tapering asset purchases. But the inventory market did not appear in any respect fazed by the Fed’s modest step.

The Fed’s new coverage assertion famous that policymakers had set a threshold of “substantial additional progress” towards inflation and labor market objectives earlier than any discount in asset purchases. “Since then, the financial system has made progress towards these objectives, and the Committee will proceed to evaluate progress in coming conferences.”

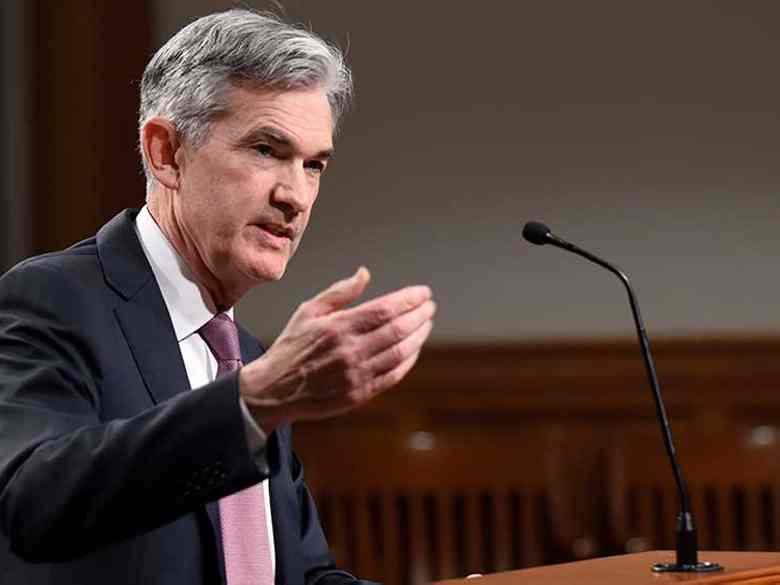

After the final assembly on June 16, Fed Chair Jerome Powell stated that financial situations had been “nonetheless a methods off” from reaching the “vital additional progress.”

In his postmeeting press convention on Wednesday, Powell stopped wanting repeating that phrase. “I might say we’ve some floor to cowl. I’d need to see some robust job numbers.” Nevertheless, Powell famous that the outlook for hiring seems to be robust.

Powell indicated he is not overly fearful concerning the financial penalties of the upsurge in Covid instances. “We have sort of realized to reside with it.”

Powell additionally mentioned the inflation outlook, saying that the inflationary impression of provide bottlenecks and hiring difficulties has been greater than anticipated.

A lot of the current upsurge in inflation hasn’t been broad-based, however moderately restricted to a couple classes like new, used and rental vehicles, Powell stated. He acknowledged near-term upside danger to inflation, however added, “I’ve some confidence within the medium time period that inflation will transfer again down.”

Inventory Market Response To Federal Reserve Assembly

Main inventory market indexes improved barely however remained combined after the Fed’s coverage assertion. Amid Powell’s press convention, the indexes continued to enhance, although they pale on the shut. The Nasdaq rose 0.7%, whereas the S&P 500 closed just under break-even after briefly turning constructive. The Dow Jones fell 0.4%.

The ten-year Treasury yield edged ticked up barely to 1.26% after the Fed pronouncements. The ten-year yield has tumbled from 1.57% since June 16, when the Fed stunned the inventory market and bond market with a hawkish shift in its outlook.

Beforehand, Fed steering had signaled no price hikes earlier than 2024. Nevertheless, quarterly financial projections issued on the June assembly confirmed that 11 of 18 coverage committee members noticed a minimum of two price hikes as acceptable in 2023. As well as, seven of 18 policymakers indicated a view that the Fed ought to begin climbing charges in 2022.

But that hawkish shift appeared to assist the inventory market. The ten-year Treasury yield fell after the June Fed assembly, as policymakers pushed again towards a way they’d completely let down their guard towards inflation. The decrease 10-year yield, a constructive for development inventory valuations, helped gasoline a inventory market rally.

Federal Reserve Taper Timing

Precise tapering of the Fed’s $120-billion per 30 days in asset purchases will not probably start till late this 12 months, or early in 2022. Nevertheless, the inventory market and, particularly, the bond market might start to cost in a forthcoming coverage shift. That may immediate a transfer increased for the 10-year Treasury yield, which might act as a headwind for development shares and the Nasdaq. Financial institution shares, whose internet curiosity margins would profit from a steeper yield curve, might get a elevate.

The Fed assertion famous ongoing danger from the pandemic. Whereas the financial danger from an surprising Covid wave seems restricted, the Fed could need to await proof that job development stays strong.

The Covid upsurge is hitting because the pandemic enhance in unemployment support will expire for 10-million sidelined employees by Labor Day. In the meantime, the regular decline in filings for brand spanking new jobless advantages has just lately stalled close to 400,000 per week.

Then again, elevated inflation readings for the reason that Fed final met might make policymakers antsy to get began with tapering asset buys, step one to tightening coverage.